Soil consumption: Greens and afo criticize building representatives

Discussion about soil protection Only 0.02 percent of Austria’s area is sealed each year, so

Discussion about soil protection Only 0.02 percent of Austria’s area is sealed each year, so

The announcement comes after the sales success of the first two shows confirmed for June

The wall street indices are trading disparately this Friday, April 19 after the sharp drop

Clemens Bauder’s organ is played in a playful way. v. left: Norbert Trawöger, artistic director

General Director Heinrich Schaller Higher interest rates, stable lending business and significantly better development of

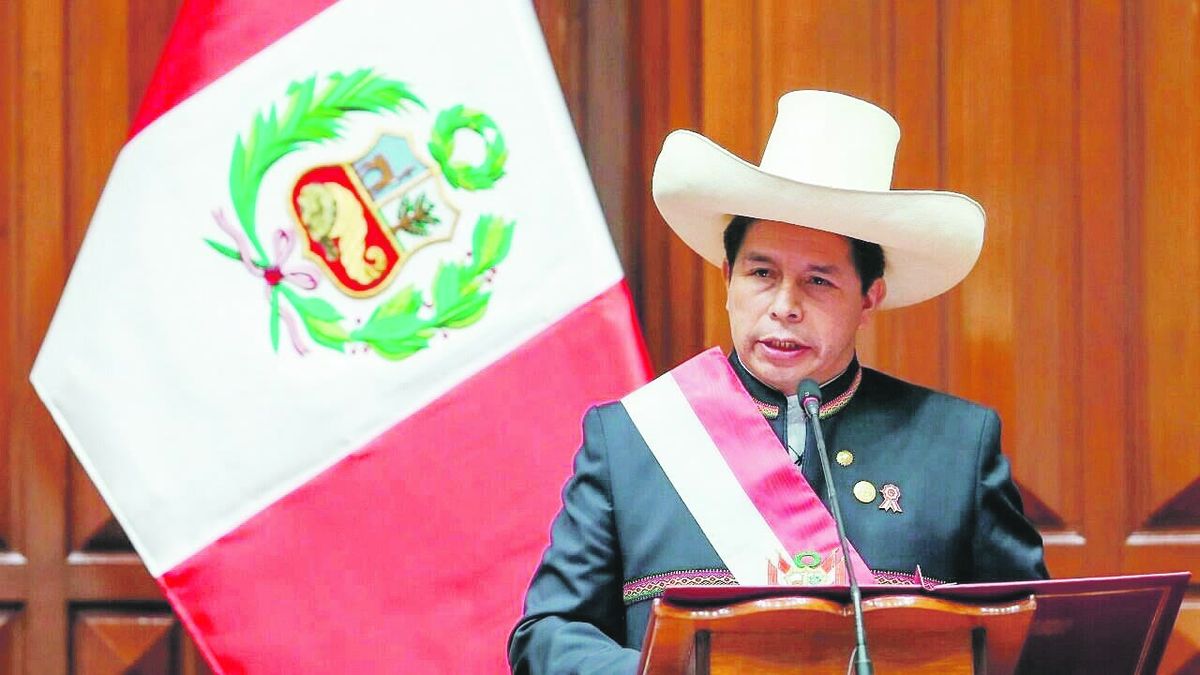

Castillo appointed as the new president of the Council of Ministers Mirtha Vasquez, a 46-year-old

The leftist president avoided giving details of the departure and announced that the new chief

“To protect the American people from a short-term crisis created by Democrats, we will allow

This closure, the second of the airport since the Cumbre Vieja volcano erupted on September

Prime Minister Boris Johnson on Wednesday called them a “nuisance” and applauded his Interior Minister

The earthquake, which occurred shallow in the southern province of Balochistán, impacted at least six

The ban on wearing any visible form of expression of political, ideological or religious convictions

The German Communist Party was not allowed to vote in the Bundestag due to the

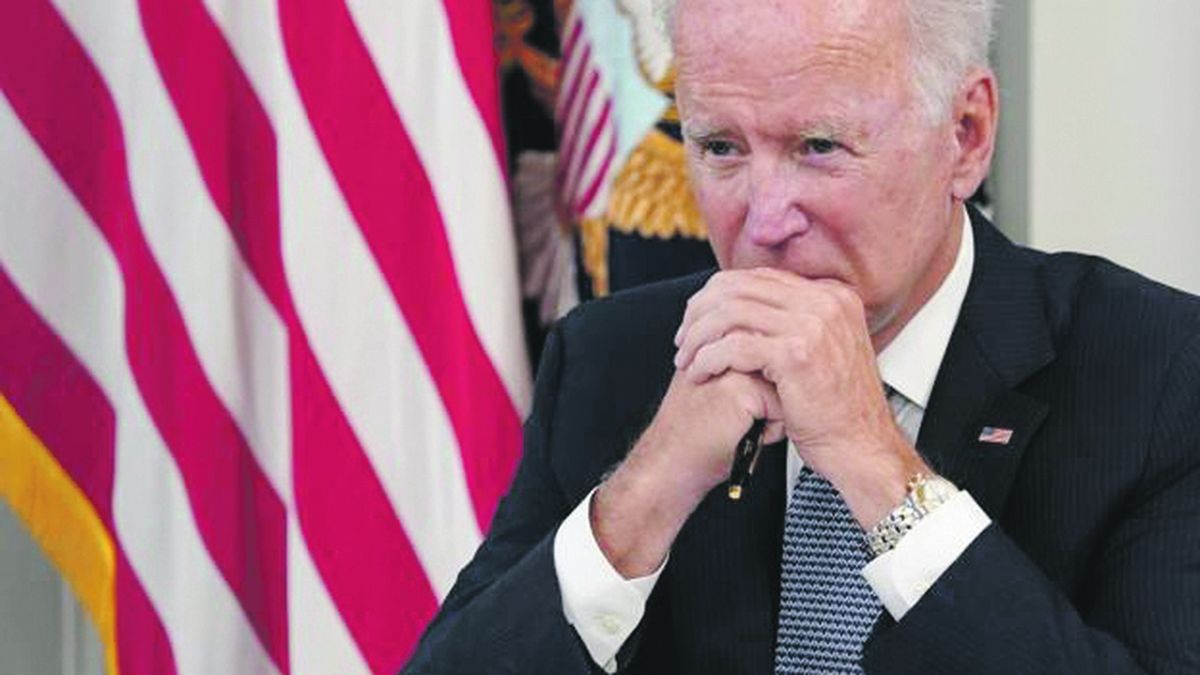

Chancellor Merkel is the first head of government from Europe to visit US President Joe

Large parts of Germany have been affected by severe storms with enormous amounts of water

The Max Original series about the life of Queen Máxima arrives very soon in Latin America. In the month of August it premieres in Max

The announcement comes after the sales success of the first two shows confirmed for June 21 and 22, which already have sold out tickets. Miranda!

Clemens Bauder’s organ is played in a playful way. v. left: Norbert Trawöger, artistic director of Anton-Bruckner-2024 and Schorgel builder Clemens Bauder A low organ

From April 19 to 28, establishments in different parts of the country will offer typical Spanish tapas. There will be music, raffles and more. The

It is the most important cultural event of the year and has been declared Intangible Cultural Heritage by UNESCO. This extraordinary celebration takes place in

Having an indoor garden provides a great deal of physical and emotional well-being. What are the ones that provide energy and relaxation to people? There

In today’s thriving online marketplace, more and more people are turning to reselling as a way to earn a full-time income and build successful businesses.

Want a charger for your Samsung Galaxy S22 Ultra that can charge fast? Here are the 7 best chargers for Samsung S22 Ultra that you

The mono-brand stores of the American company Apple of the Russian chain re:Store, operated by Inventive Retail Group, were closed on Wednesday. Izvestia correspondents were

A prosecutor for Crimes Against Sexual Integrity rejected a request from the Vélez players against the young victim of the alleged sexual abuse. The prosecutor

Formula 1 is running an additional sprint race for the first time this season at the Grand Prix in Shanghai. We explain how it works.

Fans can access this category, which gives them certain benefits and advantages when buying tickets to see their greatest passion. The followers of Boca Juniors

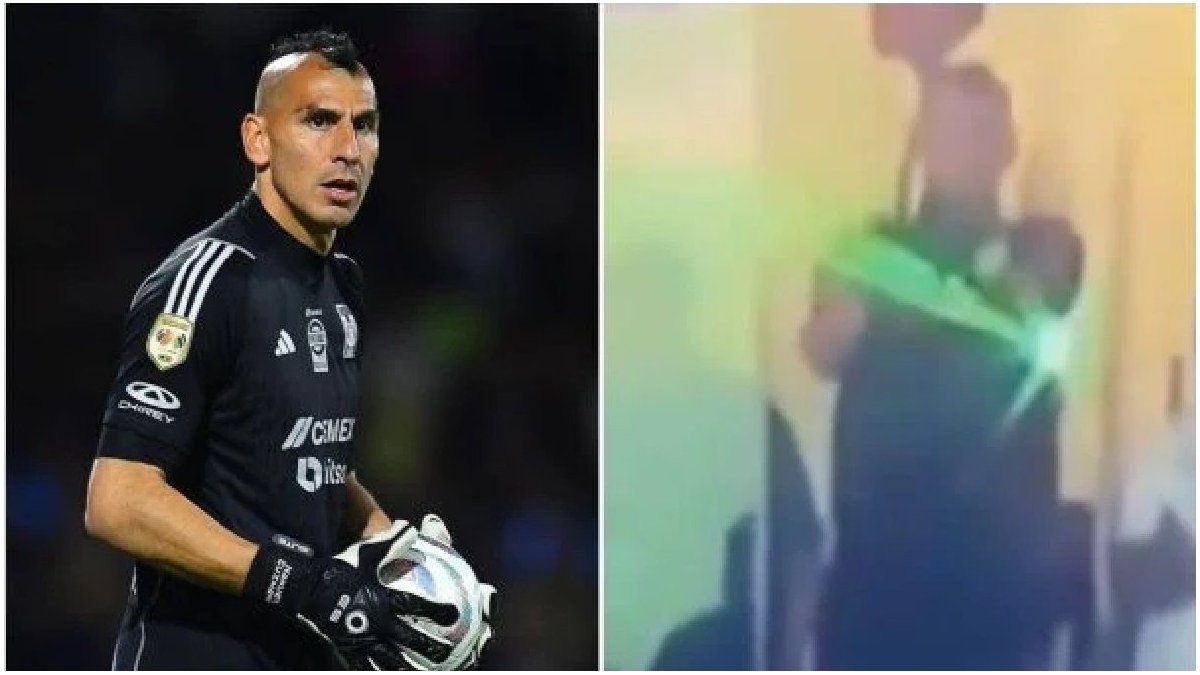

The Argentine goalkeeper was sanctioned by the Disciplinary Commission of the Mexican Federation due to the laser he pointed at his colleague and compatriot from

The sale of tickets for the Superclásico between River and Boca, for the quarterfinals of the League Cup in Córdoba, will begin this noon. The

The security agencies defined what the locations and actions at the stadium will be like for River and Boca fans, ahead of the Superclásico this

Tennis ace wanted to take revenge in Munich for the disappointments of the past few years. But this time too he is eliminated early. In

analysis Julian Nagelsmann will remain national coach until 2026. This is primarily thanks to sports director Völler, who gives the young coach the warmth that

Discussion about soil protection Only 0.02 percent of Austria’s area is sealed each year, so when it comes to land consumption, in principle “everything is

The Max Original series about the life of Queen Máxima arrives very soon in Latin America. In the month of August it premieres in Max

The announcement comes after the sales success of the first two shows confirmed for June 21 and 22, which already have sold out tickets. Miranda!

The wall street indices are trading disparately this Friday, April 19 after the sharp drop in Netflix that weighs down the Nasdaq after his gloomy

Clemens Bauder’s organ is played in a playful way. v. left: Norbert Trawöger, artistic director of Anton-Bruckner-2024 and Schorgel builder Clemens Bauder A low organ

General Director Heinrich Schaller Higher interest rates, stable lending business and significantly better development of investments have brought Raiffeisenlandesbank Oberösterreich (RLB) around 80 percent more

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.